Market Insights: Balancing Strong Momentum with Weakening Seasonality

Milestone Wealth Management Ltd. - Aug 19, 2025

Macroeconomic and Market Developments:

- North American markets bounced back this week. In Canada, the S&P/TSX Composite Index closed 1.83% higher. In the U.S., the Dow Jones Industrial Average rose 1.35% this week and the S&P 500 Index increased 2.43%.

- The Canadian dollar was mostly unchanged again, closing at 72.68 cents vs 72.54 cents last week.

- Oil prices fell this week, with U.S. West Texas crude closing at US$63.61 vs US$67.35 USD last week.

- The price of gold was up again this week, closing at US$3,453 vs US$3,411 last week.

- In the U.S., the ISM Non-Manufacturing (Service) Index came in at 50.1 in July, signaling the important service sector is still expanding, though barely. New orders (50.3) and business activity (52.6) remained in positive territory, while prices paid rose to 69.9, the highest since late 2022, reflecting ongoing demand and cost pressures. Employment (46.4) softened as companies adapt to trade uncertainty and higher input costs, but many industries continue to grow, with 11 of 18 sectors reporting expansion. The data suggests the services economy is showing resilience, holding above contraction even in a challenging environment.

- Apple boosted its U.S. investment pledge to $600 billion over four years, adding $100 billion to its February commitment, in a move that shields it from Trump’s planned 100% semiconductor tariffs and most of a 50% tariff on U.S.-bound Indian exports. The announcement, made alongside President Trump in the Oval Office, follows months of tension over Apple shifting iPhone production to India. While Trump still hints at wanting iPhones made domestically, he praised Apple’s U.S. spending and exempted it from the harshest levies. CEO Tim Cook has a long track record of using U.S. investment promises to navigate Trump-era tariff threats, a strategy that has repeatedly spared key Apple products from major duties.

- The SEC has formally ended its long-running case against Ripple Labs, leaving in place a $125 million fine and a ban on institutional XRP sales imposed by Judge Analisa Torres. The 2020 lawsuit alleged Ripple sold unregistered securities, but a 2023 ruling found XRP was only a security when sold to institutional investors. Following Trump’s return to office and a shift to a more crypto-friendly SEC, both sides sought to reduce the penalty and lift the injunction, but the judge refused. Ripple’s legal chief said the dismissals mark “the end” of the case, which follows similar SEC retreats from suits against Binance, Coinbase, and Kraken.

- Canada lost 40,800 jobs in July, well below expectations for a 15K gain, with full-time positions seeing the largest drop and youth unemployment climbing to 14.6% — the highest since 2010 outside the pandemic. The jobless rate held at 6.9% as the participation rate fell to 65.2%. Losses were concentrated in Alberta (-17K) and B.C. (-16K), while Ontario and Quebec were steady. Economists called the report “unambiguously weak” and said it bolsters the case for a Bank of Canada rate cut on Sept. 17.

Weekly Diversion:

Check out this video: Plenty of Fish for Us All

Charts of the Week:

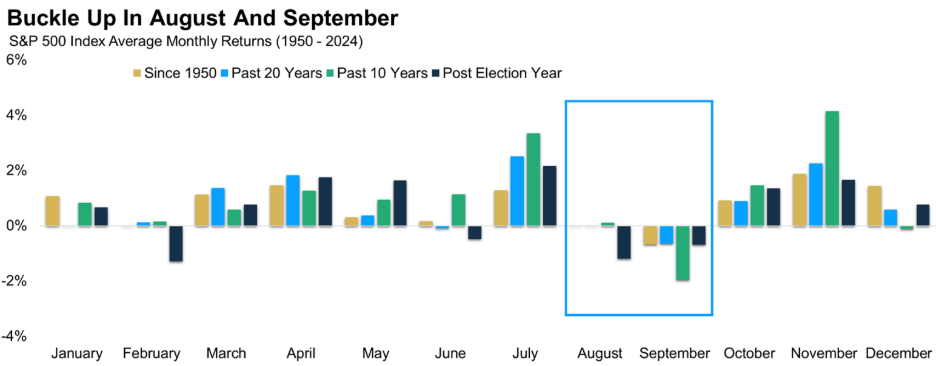

After several months of steady gains, recent shifts in the stock market suggest a period of increased volatility may start to settle in. While strong summer rallies have boosted major indices, a natural pause and heightened price swings are typical as the summer progresses, especially following significant rallies. Although historical trends point to challenges ahead in the near-term, particularly during late summer and early fall, as highlighted in the chart below, these patterns should not necessarily dictate investment decisions in isolation. U.S. economic data also hints at some headwinds: slowing growth and a relatively tight monetary policy from the Fed create a more complex backdrop for markets moving forward.

Source: Carson Investment Research, YCharts, @ryandetrick

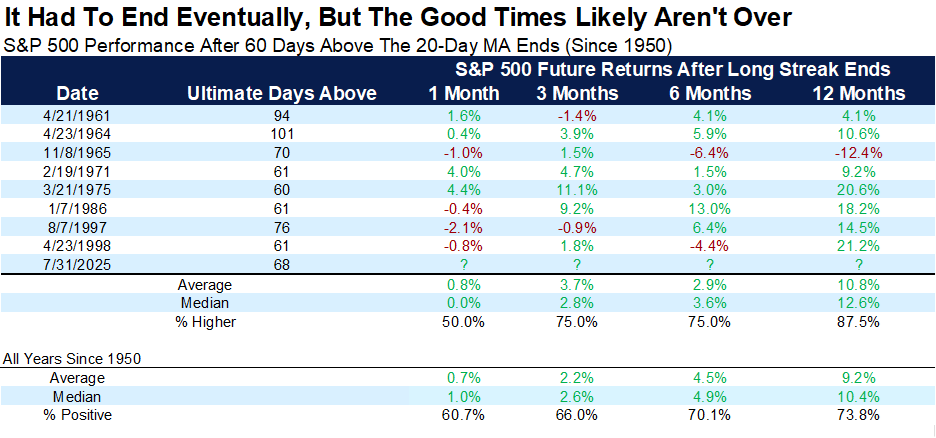

Despite these challenges, historical analysis reveals that periods of robust performance tend to signal continued strength for stocks in the months ahead. In years when markets have posted consistent gains through spring and early summer, the momentum often sustains, and future returns generally remain positive. Major indices maintaining strong uptrends—even when temporarily interrupted—have frequently led to additional upside by year-end. Notably, streaks of sustained growth have historically ended with only brief pauses rather than sustained pullbacks, as shown in the next chart. As we can see, for periods after 60 days or more above the 20-day MA (currently the ninth time since 1950), the S&P 500 has performed reasonably well for the remainder of the year with six-month median forward returns of 3.6% (a bit below all years) and positive returns 75% of the time (above average for all years) and 12-month median forward returns of 12.6% (above average) and positive returns 88% of the time (also above average).

Source: Carson Investment Research, FactSet, @ryandetrick

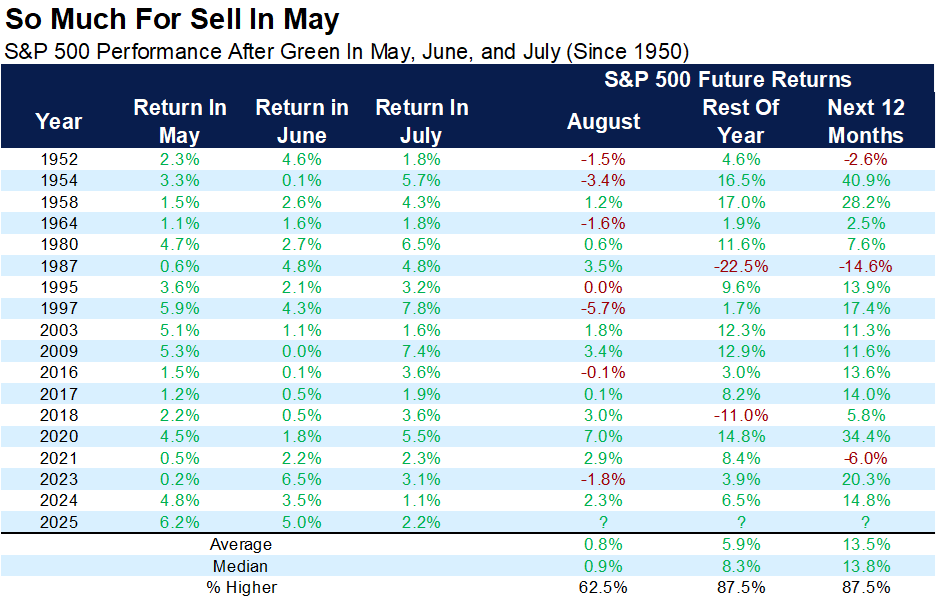

Technical indicators sometimes reveal internal weaknesses even as headline numbers stay impressive, but these signals have not yet outweighed the prevailing strength. Meanwhile, well-known seasonal adages—such as the caution to “sell in May”—have not held up in recent cycles. As always, it is important to look at a broad array of economic and market trend indicators. Instead, data supports a more optimistic interpretation: late spring to early summer rallies frequently lay the groundwork for more gains, with similar historical periods finishing the year in positive territory, as shown in the last the chart where the S&P 500 was positive in May, June and July. The average and median rest of year return in these past instances has been very strong at 5.9% and 8.3%.

Source: Carson Investment Research, FactSet, @ryandetrick

In sum, while vigilance is warranted in the face of short-term historical seasonal weakness, the weight of evidence continues to support a constructive outlook for equities. Patience, perspective, and a focus on long-term patterns remain key virtues for investors navigating the coming months. It is for this reason that Milestone follows a seasonality approach, raising some cash during the summer months while still remaining invested in the markets.

Sources: Yahoo Finance, Reuters, Carson Investment Research, FactSet, YCharts, @ryandetrick

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.