Performance

| | Return History |

| | US Bonds* | Demos Strategy** | US stocks* |

| | (BBgBarc 1-5 Yr Treasury) | | (S&P 500 Comp TR) |

| 2020-06 | 0.1% | 0.8% | 2.0% |

| 2020-07 | 0.2% | 0.5% | 5.6% |

| 2020-08 | -0.1% | 1.1% | 7.2% |

| 2020-09 | 0.0% | 0.5% | -3.8% |

| 2020-10 | -0.1% | -0.5% | -2.7% |

| 2020-11 | 0.1% | 2.1% | 10.9% |

| 2020-12 | 0.1% | 0.6% | 3.8% |

| Cumulative | 0.3% | 5.3% | 24.4% |

| | Spread in Returns |

| Minimum | -0.1% | -0.5% | -3.8% |

| Maximum | 0.2% | 2.1% | 10.9% |

| Difference | 0.3% | 2.6% | 14.7% |

All returns are presented in $USD

* Source : FactSet, Morningstar, Raymond James Ltd.

** Time-weighted gross return

Why choose this strategy?

Several clients ask us what strategy we can adopt in the current economic context. With interest rates being so low and stock prices being so high, we need to get creative to generate income while managing risk.

We have developed a strategy that generates very attractive and recurrent income. If options gains qualify as capital gains for you, as it usually does for most people, our strategy would also be tax efficient as capital gains are less taxed than income. We will explain our strategy in more details in just a few moments.

But first, let's define what we mean by "the current economic context".

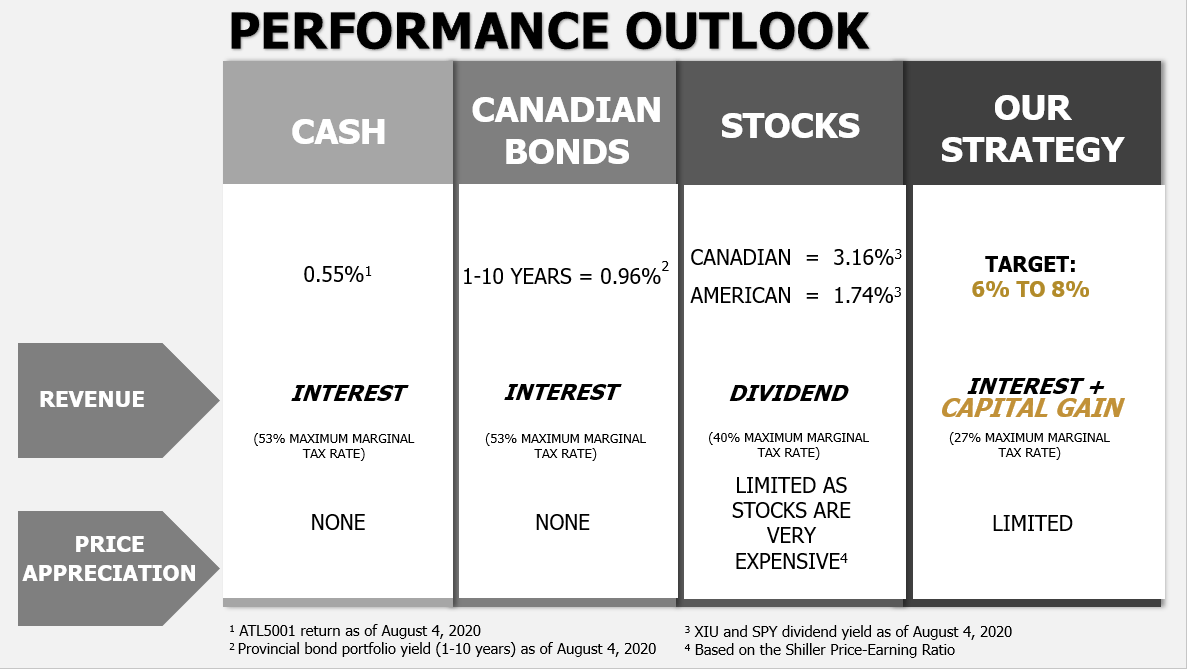

Let’s first look at what type of income we can expect right now. The 0.55% yield on cash comes from a high interest savings account. For Canadian bonds, the 0.96% return is on a 1-10 year provincial bonds portfolio. With such low returns, it’s challenging to live off income without using up capital. On the equity side, you can see the dividend rates for the Canadian market (3.16%) and the US market (1.74%). Meanwhile, our strategy aims for an annualized return of 6% to 8%, which is significantly higher than other sources of income currently available.

Aside from income, we've also indicated what type of price appreciation we can expect for each category. Of course, cash and bonds are categories that are meant to pay interest, rather than increase in price. As for stocks, it's true that they earn more than just a dividend. However, with the current market valuation, we strongly believe that price appreciation is limited. We invite you to read our article on our return expectations for more details. Ultimately, our strategy focuses more on income generation than price appreciation, although some appreciation is possible. It is also important to mention that the capital gain generated by our strategy is less taxed than interest or dividend income.

How the strategy works

So, without further ado, we'll explain our strategy to you. The strategy consists of selling options that give us a certain amount of money, called a premium, and in exchange for this premium, we agree to buy the stock of a company if and only if it falls below a price we choose, the strike price, during a selected predetermined period.

Here are some important things to remember:

- We are committed for periods of 90 days maximum.

- Companies are chosen for their fundamental qualities. We look in particular at their ability to generate positive liquidity and a reasonable debt ratio. We could decide to hold them for the long term.

- We are aiming for a “cushion” between 10% and 15%. In other words, the stock will have to drop 10% to 15% within 1 to 3 months for us to be impacted.

- The premium received generally qualifies as a capital gain if the option is held until maturity, so only half of the return would be taxable.

- At the end of the option, if the price has not fallen sufficiently, our commitment ends and we start the process again. Otherwise, we end up buying the company's stock with the cash we kept aside.

Benefits and risks

Like every financial decision, our strategy has its benefits but also its risks. The key benefit of the strategy is to provide recurring and tax-efficient income. Another clear benefit of the strategy is that it offers a potentially lower level of volatility than investing directly in stocks. The risk is reduced because of the 10% -15% cushion and short-term commitment. The main risk is that of a rapid market crash that would force us to buy the stocks of the companies at a higher price than the current market value.

Our strategy provides a significant advantage for private business owners or for professionals who are incorporated and who hold significant excess liquidity. It could help reduce the tax bill! In most cases, half of the realized capital gains can be withdrawn from the company without paying tax from the capital dividend account, commonly referred to as the CDA.

We've just covered the basics, but for more details on how our strategy works, we invite you to read our second article on the subject.

In conclusion, we strongly believe that our strategy is the best solution to invest large sums in the current context. With an annualized return target between 6% and 8%, this is significantly more attractive than what bonds and dividends can offer, especially after tax. On the other hand, it should be noted that this strategy is only possible in margin accounts, either individual or company that it is subject to certain minimums.

To find out more, we invite you to contact us directly at the contact information at the bottom of the screen. Thanks for reading and don't hesitate to share!

Please note: this strategy is only available in margin accounts, either individual or company and is subject to certain minimums.

Disclaimer

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. Raymond James advisors are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. The views are those of the author, Marc-André Turcot, and not necessarily those of Raymond James Investment Counsel Ltd. Investors considering any investment strategy should consult with their investment advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision.